“Embrace what makes you special.”-Dave Zilko

Most people have heard of Garden Fresh Salsa. What many people don’t know is how difficult it was for former vice chairman Dave Zilko and founder Jack Aronson to grow Garden Fresh from a bankrupt startup into a $231 million-dollar business.

I’m sitting at Fuel Leadership headquarters in Downtown Birmingham with Dave Zilko.

Dave is now CEO of Fuel and graciously invited me to talk with him about his life. I read his amazing tale ‘Irrational Persistence’ and was very impressed by his uncompromising perseverance and it’s an honor to be here.

Dave is a Detroit entrepreneur and business veteran who helped grow Michigan’s own Garden Fresh Salsa into the dominant # 1 fresh salsa brand in the world. All the odds, however you look at them, were stacked against Garden Fresh but they prevailed over seemingly impossible odds.

Reading Irrational Persistence is akin to taking an MBA course. It’s an honest account of real-world experience and it doesn’t get any more authentic than personal experience as told from an entrepreneurial fighter’s perspective.

If you’re thinking of starting a business, you should read this book. It should be required reading for all MBA programs as a real-world case study.

Business can be warfare. Entrepreneurial Warriors need to suit up for battle, while forging an advanced morality, so you’re not heartless or slimey in your dealings with others. Business is the Art of Aligning Compatible Relationships for Mutual Profit.

When Dave and Jack pooled their resources together, they were millions of dollars in debt.

However, they were talented, hardworking, had great products and assembled a great team and they were able to grow Garden Fresh into a $231 million-dollar company, which they eventually sold to Campbell’s in 2015.

The success of Dave Zilko will change your conception of what is possible if you’re a hardworking and persistent entrepreneur.

Biography

Dave Zilko is an enterprising Detroiter. He received his B.S. in Finance from Michigan State University, and his MBA in Marketing from George Washington University in Washington, D.C.

He’s an operating partner with Huron Capital and serves on various boards like Forgotten Harvest (USA’s largest food rescue organization), Jimmy Buffet’s Margaritaville Enterprises charity arm Singing for Change, Grow Michigan venture fund, the WSU Ilitch School of Business and more.

Dave Zilko went thru hell to get where he is. In the early days, he was up to his eyeballs in student loan debt, selling marinades and life insurance and cracking hundreds of thousands of eggs by hand.

This is his tale.

“I was born and raised in Warren, Michigan, grew up at 11 ½ Mile Road and Van Dyke. I have wonderful parents and was the first one in my family to go to college. Worked my way through school. I used to be a bagger at Great Scott (now Kroger) for $2.14 an hour.”

“In terms of money management, I’m self-taught. I saved money on my own because I really wanted to go to college. I had paper routes when I was 12.”

“Always been drawn to writing. I was even the editor of my high school newspaper. Putting my personal story on paper in book-form was one of the hardest things I’ve ever done in my entire life because it’s tough knowing what to include and not include.”

“My ultimate goal with the book is to help aspiring entrepreneurs understand just how hard it was and how long it took to build a successful business. We struggled hard for over a decade to build the company.”

“After MSU, I spent a life-changing summer in France and fell in love with the food and wine culture there. Came home, did an internship at GM in Downtown Detroit. Then went to Washington, D.C. for grad school. I lived in Georgetown and had a great time.”

“After graduating, I decided to follow my passion and start a specialty food company called American Connoisseur, where I started making marinades. My first order was for 96 cases. Only problem was I had nowhere to make them.”

“So, I found a spot in Sylvan Lake, Michigan, a tiny medieval dungeon of an office, and got right to work. The good people at Discover credit card company soon discovered that I couldn’t qualify for a loan, so I asked my girlfriend to help me out. She thankfully did and yes, we’re married now.”

“After that I bought Mucky Duck Mustard Company. The owner, Michelle Marshall, was retiring and she owned a forklift, which we badly needed, so I bought the company from her with an $108,000 loan from my dad. Michelle originally started the company in the 1980’s at her house in Franklin, Michigan.”

“Mucky Duck is a British pub-style mustard, so eggs are an ingredient. For years, every day at 5 a.m., I had to personally break eggs for the mustard. I estimate that I’ve broken over 800,000 eggs over the years. Mucky Duck won the world championship of mustard one year and I still own the company.”

“11 years later, after my lost decade, I met world softball champ and Detroit entrepreneur Jack Aronson in 2002 at a food industry show at the Javits Center in NYC. Jack and I were both in debt, both Detroiters, both food lovers and we became friends immediately.”

“Jack is an amazing individual. He’s an energetic dreamer and unrepentant softball fanatic and I’m proud to be his friend. Together, we made Garden Fresh Salsa internationally popular.”

Garden Fresh Salsa: You get what you pay for

Salsa originated centuries ago among the Incas and Aztecs. It wasn’t called “salsa” until 1571 and it wasn’t brought to the United States until 1916 when they started making it in New Orleans. Jack started Garden Fresh in 1997.

Fans of Garden Fresh Salsa say, “it’s worth it, it’s like you made it yourself.” Garden Fresh uses all-natural, high-quality ingredients which creates a memorable and almost addictive flavor profile.

In June 2015, Campbell’s bought Garden Fresh for $231 million dollars.

$231 million dollars is a lot of money. Picture 231 piles. Each pile has $1 million dollars. What’s harder to imagine is how incredibly difficult it is to generate that kind of money. Especially from an originally bankrupt startup making salsa in the unlikely city of Ferndale, Michigan, which, being a small Midwestern city, had zero salsa street cred.

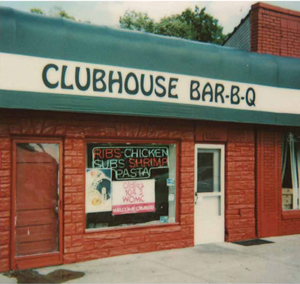

Garden Fresh Salsa was launched by Jack Aronson in the back of his now-closed restaurant, Clubhouse Bar-B-Q (22016 Woodward, Ferndale, MI). Jack was making the salsa in 38-lb. batches inside 5-gallon buckets and had $4.6 million dollars in annual sales when he met Dave.

In 2002, when Jack formed a partnership with Dave, their goal was to get to $10 million dollars in ten years. Instead, Dave helped get them to $110 million dollars. Garden Fresh became the #1 brand of fresh salsa in the United States, making up 31% of all US salsa sales.

Then they became the largest brand of tortilla chips sold in deli’s, and after purchasing Inkster-based Basha Hommus in 2007, they became the 3rd largest hummus manufacturer in the US.

“Jack Started making the salsa at Clubhouse. One day, Jim Hiller of Hiller Markets showed up, he tried the salsa, loved it and started carrying it at his 6-store grocery chain. That’s how it got started.”

“When I joined Jack in 2002, we did everything together. Jack and I were strategically in sync. For the first 5-years, I was in the plant daily. Then gradually, I handled deals and traveling, while Jack handled operations, which was getting the products made and to market.”

“Our absolute uncompromising commitment to high-quality helped create an almost legendary brand loyalty among customers. For instance, some analysts told us that we could save $213,000 per year by not hand-peeling the onions. We didn’t listen to them because we refused to compromise the integrity of our flavor profile.”

“Also, to this day, 75 tons of Garden Fresh salsa are made daily in 5-gallon buckets. Back in the old days, it took us 20 minutes to make 6 pints of salsa. Now, assembly lines make 6 pints every 9 seconds. That’s 1,500 pints of salsa every 10 minutes.”

Garden Fresh: Turning Points

“Bringing in a Creative Director to get the branding right was essential, as was the strategic pivot to become a full-service deli supplier. We bought a tortilla company, a hummus company, we did the Margaritaville deal, etc. We were on a roll.”

“Another huge turning point was the introduction of the High Pressure Processing (HPP) machines. HPP helped Garden Fresh become the world’s largest fresh salsa company.”

“Jack has always loved fresh, natural ingredients and hated preservatives like sodium benzoate and potassium sorbate. However, we had a big problem.”

“Garden Fresh had managed to get into Costco, which is an enormously difficult thing to do in and of itself, and within 18 months, we were the #1 salsa. Costco was our largest customer, they were buying $20 million dollars’ worth of product annually.”

“Problem was that our products were literally exploding on the selves at Costco. We had to make larger 48oz. Costco club format bottles of Garden Fresh salsa and we couldn’t keep the salsa fresh for a long period of time, so gases would build up and they would explode.”

“HPP changed everything. HPP machines apply 87,000 pounds of pressure to food, killing all bacteria, which makes the food last 5x’s longer. No preservatives are needed. HPP machines are developed by Avure in Columbus, Ohio and manufactured in Sweden.”

“The machines are not cheap. They’re $2 million dollars each. And they weigh 105,000 pounds each! You have to have at least a 6-inch thick concrete floor just to support them.”

“In order to get the machines, we had to secure an Industrial Revenue Bond. When I showed up to sign the documents, I found myself in an office, staring at a large conference table. On the table were 43 stacks of paper, each stack about 6-inches high. It was worth it because HPP’ing the salsa changed everything.”

Garden Fresh: Sold to Campbell’s for $231 Million Dollars

“It was not easy to sell Garden Fresh to Campbell’s because we had worked so hard building our company over the years. Myself, Jack, his wife Annette and their 5 kids worked there. Jack grew the company from nothing. We were very attached to Garden Fresh.”

“However, we felt we had taken the company as far as we could. Competing for shelf space with giants like Nestle and other Fortune 500 companies is wicked. For instance, recently, Nestle, the world’s largest food & drinks company, paid Starbucks $7.2 billion dollars to sell its coffee. These are monster companies with inconceivably vast resources.”

“Campbell’s secret internal name for the deal was ‘Project Diamond’. It took awhile to finalize the arrangement and close the deal but eventually we signed the 104-page purchase agreement and Campbell’s added Garden Fresh to their product portfolio.”

“In business, you try to create the best products you can and gain market share. You also have to know when to hold and when to fold and due to uncontrollable market forces, it was the right time for us to exit.”

“After the deal, I did consulting for Garden Fresh for 6 months. Jack still consults with them on occasion. Jack’s big focus now is his company Clean Planet Foods in Clinton Township. Jack and I remain great friends and we still talk at least 2-3 times per week.”

Fuel Leadership

“After Garden Fresh, I joined Fuel Leadership as CEO. Fuel is a video-centric digital media company and we’re bringing a fresh perspective to leadership development. We target millennial professions ages 18-34 and storytelling is our preferred method of communication.”

“How it works is we sit down with an individual for 45 minutes and film them as they tell us about their life and work. We distill the final interview down to 2 minutes. We’ve interviewed over 50 people so far, including AOL co-founder Steve Case and clothing designer John Varvatos.”

“We’re also working on Fuel U. We’re reinventing the university newsletter model to make it more relevant, interesting and easily digestible for busy people. Launching this Fall, four University of Michigan Ross business students will make an UM specific newsletter at Fuel.”

Huron Capital

Located in the beautiful art deco Guardian Building in Downtown Detroit, Huron Capital is a private equity company. They have a “buy-and-build” investment model and have raised over $1.7 billion dollars by investing in 130+ companies through 6 private equity funds.

“Huron has a diverse portfolio. I’m an Operating Partner, which means I don’t have a formal association. They buy companies and they send me food deals and I analyze the deals for them.”

“For example, in 2011, they bought Brooklyn-based Victoria Pasta Sauce and I joined the board. They fixed up the company and sold it in 2016.”

“Huron Capital is a class act, both personally and professionally. I met Jim Mahoney, one of their senior partners. He introduced me to the founding partners and that’s how I came onboard.”

Dave’s Final Thoughts

“Sometimes you have to be irrationally persistent to be successful in business.”

“95 out of 100 new businesses fail. So, by definition, starting a new business is not rational, since it only has a 5% chance of succeeding. If you believe in it, you must persist. If you can make it to the 10-Year Mark, you’re doing good.”

“Fresh salsa was an emerging market at the time and we had the best flavor profile by far. Garden Fresh went from $4mil to over $100mil in a decade.”

“I look for the holy grail of American capitalism: emerging markets that are not yet saturated. My advice to you is look for the holy grail and build that company with strategic layers that your competitors can’t match.”

“I’m also a huge fan of higher education. The most valuable thing I got out of MSU was my social development skills. Being immersed in a university environment took me out of my shy protective shell. During my grad school years at George Washington, they had the Harvard Case Study format, where they presented cases that we had to solve. It was there that I truly learned how to trust my strategic instincts.”

“During my summer in France, I came to enjoy European “stealth service” at restaurants, where they don’t interrupt you. The European approach to food is fundamentally different than ours. Americans are optimistic by nature, Europeans are more pessimistic because their countries are older and more experienced. They think tomorrow will be worse than today, so they live more in the moment than we do. Americans are gradually becoming more European though, especially millennials.”

“My wife and I love Chardonnay, good conversation and good food. We also love Michigan. The Traverse City area is especially beautiful.”

“Never thought in my lifetime that Detroit would be where it’s at right now. I’m absolutely thrilled. Detroit was in decline for 50 years, now it’s coming back strong. During my travels, I’ve really cultivated a deep appreciation for the Detroit ethos, people, beauty, low cost of living and all of the amazing resources we have here.”

“I have a passion for business. I love food. I am driven largely by the intellectual stimulation of trying to create value. I love the art of business. There is definitely an underappreciated art to good business practices.

“Part of me is achievement-oriented, I need to be busy and creating value, so I don’t know if I’ll ever fully retire.”

“Whatever you do, in both your personal and professional life, commit to a standard and never deviate from it. It’s better to have clearly defined values and stick to them, rather than compromise your own personal integrity.”

Daily Fuel

Irrational Persistence

https://www.amazon.com/Irrational-Persistence-Secrets-Bankrupt-Business/dp/1119240085

Huron Capital profile

https://www.huroncapital.com/member/david-zilko/